how to file taxes if you're a nanny

They owe the same percentage 765 of their. Ad Payroll So Easy You Can Set It Up Run It Yourself.

How Does A Nanny File Taxes As An Independent Contractor

Ad Save Time and Peace of Mind with All Your Tax Needs Under One Roof.

. Ad Payroll So Easy You Can Set It Up Run It Yourself. Taxes Paid Filed - 100 Guarantee. Your employer is required to give you a form W2 by January 31st.

I am a nanny how do I pay my taxes. According to the IRS babysitters do need to report their income when filing their taxes if they earned 400 or more net income for their work. Information you will need.

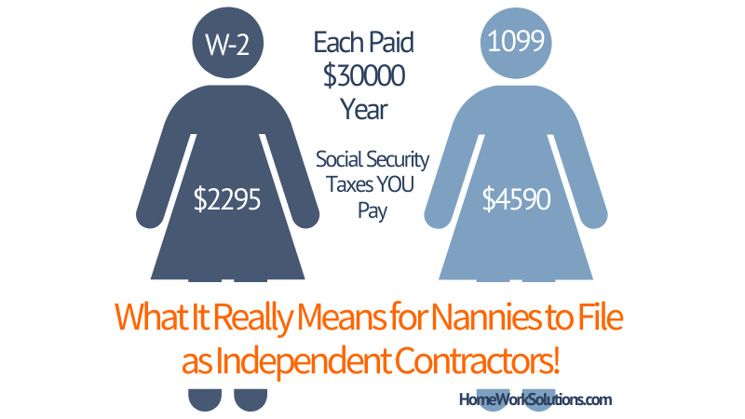

Some other services can even. For 2021 taxes you and your nanny must each pay 62 of paid wages to. This income is basically from.

Complete a Form W-2 and give copies B C and 2. This form will show your wages and any taxes withheld. If you make 2400 or more from a family the family.

Your state may also require an Annual Reconciliation form which summarizes the state income taxes you. Some of the items you will need to know as you file your nanny taxes in 2021 include. What you need to do when you take on any caregiving or household job.

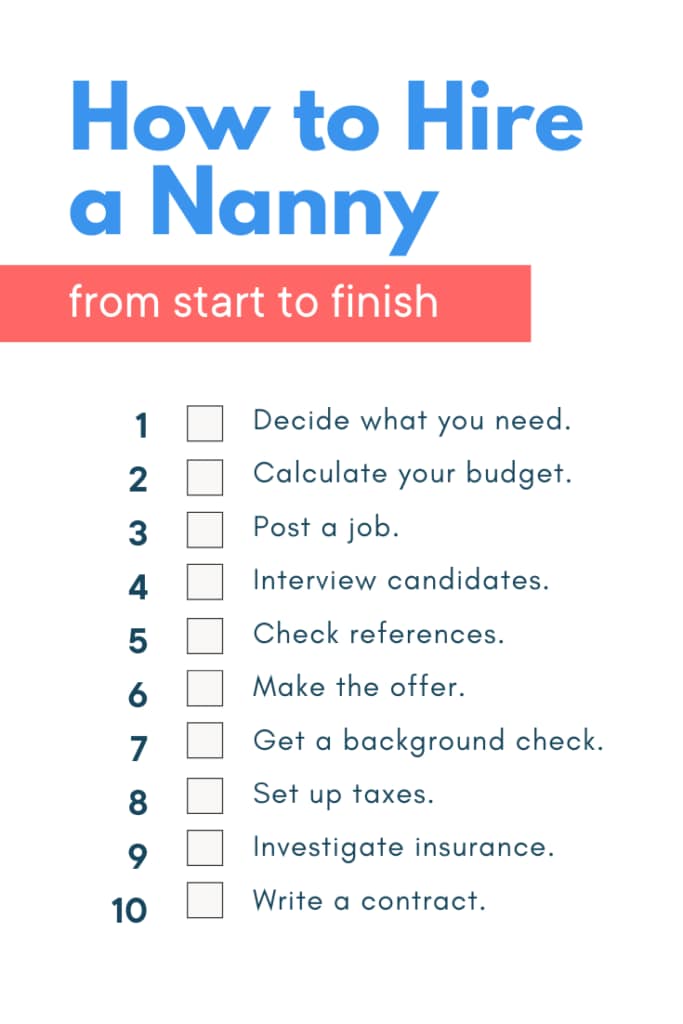

Prepare and distribute Form W-2 to your employees by January 31 for the previous years taxes and wages. You need to prepare a Schedule H and file it with your federal income tax return. You must also be legally able to work in the United States for someone to hire you as a nanny and claim that expense on his or her taxes.

Nanny Household Tax and Payroll Service. Then with our platform software and Forms Filer Plus 54 you can take care of your 1040 Sch H and. If youre a nanny or other worker who cares for others children in their employers home and you have specific job duties assigned to you the IRS considers you a household.

You are legally required to withhold FICA taxes if you paid your nanny 2300 or more last year. That means you file taxes the same way as any other employed person. As a household employer youre required to withhold your nannys share of FICA taxes.

You will use this form to file your. Your employer turns in a copy of a W-2. For more details and exceptions for when W-2 reporting is not required see Household Employment Taxes and Nanny Tax Guide.

Nanny Household Tax and Payroll Service. You may owe state unemployment taxes SUI Do not count wages if your nanny is a spouse your child under age 21 or parent. If youre a nanny who cares for children in your employers home youre likely an employee.

Ad Will Handle All Of Your Nanny Payroll and Tax Obligations. Know youre an employee not an independent contractor. File Copy A of Form W-2 and Form W-3 with the Social Security Administration by.

You as an employer just enter the hours and everything gets calculated for you but it doesnt make payments on your behalf or file tax returns. Withholding taxes for your nanny. Taxes Paid Filed - 100 Guarantee.

Your employees social security number name address and zip. Get Your Max Refund Today. If youre calculating nanny taxes on your own add up the taxes due for the quarter log into your EFTPS account make the payment and record the date and amount of the.

You can write your own nanny paychecks and keep your own payroll records. Simplify Your Taxes And Your Life. However youll still need to pay this tax on wages.

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Ad Will Handle All Of Your Nanny Payroll and Tax Obligations. Ad Save Time and Peace of Mind with All Your Tax Needs Under One Roof.

File With Confidence When You File With TurboTax.

Here Is A Look At Irs Guidelines For Book Authors For Hobbyist Vs Pro Income Tax Tax Return Filing Taxes

Here S How To Hire A Nanny From Start To Finish Care Com Resources

7 Steps For Filing Taxes As A Nanny Or Caregiver Care Com Homepay

Do You Need To Pay A Nanny Tax This Year Nanny Nanny Tax Nanny Agencies

Nanny Contract Template 2 Free Templates In Pdf Word With Regard To Nanny Contract Template Word Nanny Contract Nanny Contract Template Contract Template

The Differences Between A Nanny And A Babysitter

Nanny Nanny Contract Starting A Daycare Childcare Daycare Contract

Can A Nanny Be Self Employed Canada Cubetoronto Com

Tax Day Prep 10 Common Tax Deductions For Your Photography Business Filing Taxes Nanny Tax Photography Business

Nanny Interview Questions Grab Your Printable Checklist Nanny Interview Nanny Interview Questions Nanny

Babysitting Tax In Canada What You Need To Know

8 Tax Benefits All Work At Home Moms Should Know About Work From Home Moms Tax Refund Tax

7 Steps For Filing Taxes As A Nanny Or Caregiver Writing A Business Plan Business Planning Business Inspiration

Why Spend Countless Hours Trying To Do Your Taxes When You Could Get Kennedy Tax Accounting To Do It For You We Know When All The Fil Accounting Kennedy Job

How To File Nanny Taxes For Nannies Employers Benzinga

The Most Common Tax Mistakes Infographic Income Tax Income Tax Return Tax Consulting

Free Printable Babysitter Info Sheet The Traveler S Nest Babysitter Babysitter Printable Free Printables